Robin Hood and His Merry Robo-Advisors

There are a lot of young brokerage and wealth management companies starting today with a modern technology twist. As a group, we call them robo-advisors. We like dumb, inappropriate names.

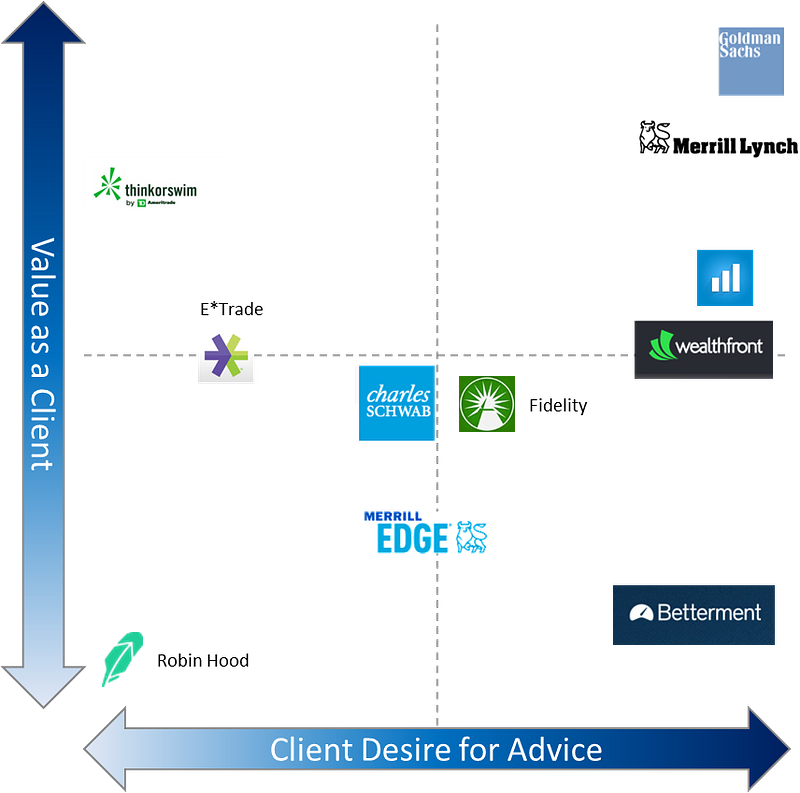

They are all new. They all leverage technology more than wealth management incumbents. The similarities end there. Each of them is attacking a unique client segment, and using technology to enhance a distinct part of the client experience.

Personal Capital. Betterment. Wealthfront. Robin Hood. All grouped the same, all serving a different part of the market.

The Lay of the Land

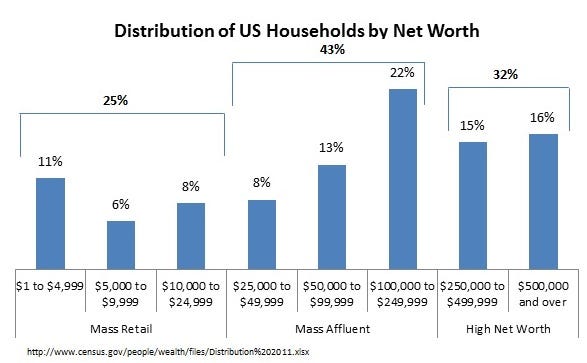

Most brokerages and investment advisers today specialize in on one of three segments, because the economics of those clients and needs of those clients differ greatly.

Today, the 32% of High Net Worth households are the best served segment. These are who the established, old school players (think businesses with Investment Banking arms) serve.

At the low end, are the Mass Retail. They make up 25% of American households with less than $25K in net worth. Let’s do some simple math. If you have $25K in a product that charges a 0.5% of your assets as a fee, the brokerage is making $125 a year off your account. If you make 10 trades a year at a $7 commission, they are making $70 a year off you. After sending you statements for $20-$40 a year, you just aren’t worth that much to them — and that’s the best case for the Mass Retail. Many of these accounts break even for the brokerage after accounting for the cost of service (which arguably could be lower for many players). If you are in this segment, you may have noticed they really want you to sign up for those estatements.

In the middle, you have the 43% of Mass Affluent households. This is who the industry is fighting over today — there isn’t a model that fits them well yet, but they have enough assets to be profitable under several business models. At the higher end, they may have a “Full Service” adviser just like the High Net Worth. At the low end, many who want advice are not willing or able to pay for it. This group is one of the most popular to target at the moment. The startups and the existing players are all trying to cut the cost of service to this segment, to profitably scale to serve their desire for advice but lower ability to pay for it.

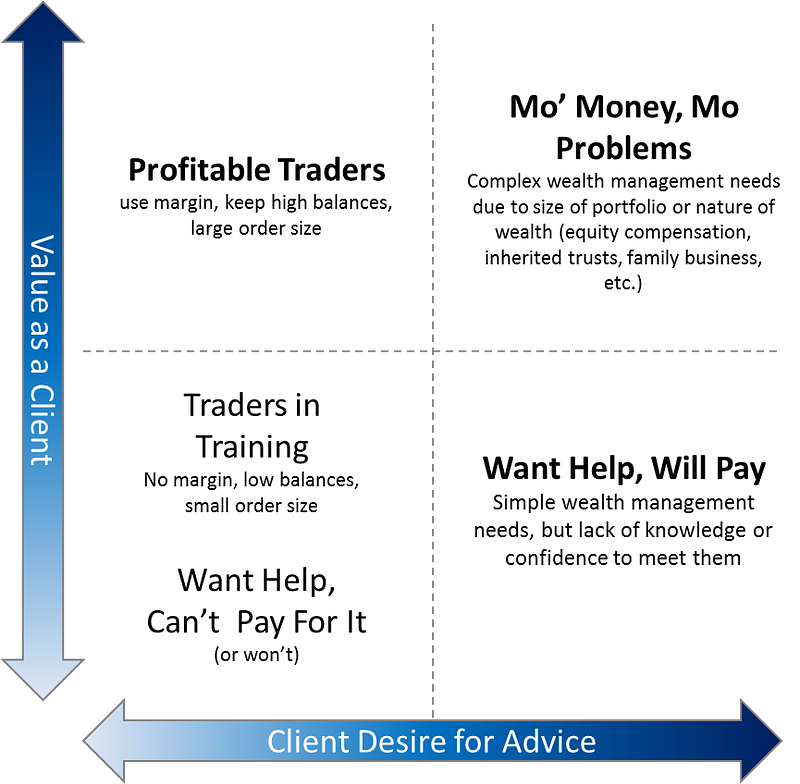

The finest 4 quadrant grid PowerPoint can provide. Sorry I’m so fancy.

The finest 4 quadrant grid PowerPoint can provide. Sorry I’m so fancy.

The Start Ups:

Very different products are attractivg very different customers

Very different products are attractivg very different customers

Personal Capital: Your Dad’s Adviser, but more efficient on all fronts

Personal Capital’s Mint-like customer acquisition tool

Simply put, Personal Capital is about making a traditional adviser as efficient as possible. A Mint-like reporting front-end acts as a client acquisition tool, and a pre-qualifier. Most advisers struggle to find qualified prospects, but Personal Capital is built with a great prospect filter, thanks to the outside account information you willingly hand over.

When a prospect crosses $100k of assets on the reporting tool, a human come into play — and the technological innovation goes behind the scenes. Now a modern CRM passes prospect information to an advisers assistant, who further pre-qualifies leads by confirming the prospects interest and setting up an appointment. This seems simple, but most of the established players cannot do this without significant fulfillment errors thanks to years of technical debt embedded in legacy systems.

Next the adviser collects more information from you, and decides which of their managed products (centrally managed model portfolios) is most appropriate for your situation. The actual investment decions are centralized, so the adviser focuses on what they do best — holding the clients hand, customizing the plan at the margins, and providing a sounding board for financial decisions in general.

So to recap — Personal Capital is an innovative use of technology as an effective prospecting and pre-qualifying tool. Their best in class use of CRM to direct assistants and advisers to keep up with you by email and phone is a huge differentiator compared to the biggest players in the space. Lastly, they use managed products to simplify and standardize the actual investment experience. It all adds p to a traditional experience, but with technology allowing the adviser to provide a high touch feel at scale.

Betterment: The “Keep it Simple” Advice Algorithm

Front and center on the homepage — get started as quickly and simply as possible

Front and center on the homepage — get started as quickly and simply as possible

Betterment seems to take to heart a simple fact: The most important decision 84% of Americans (who are not high net worth) make is not how to invest — it’s how much to save.

Betterment has the 80⁄20 rule at it’s heart: They don’t want you to think about wringing every last bit of performance out of your investment strategy. Their focus is on getting you to not make a mistake — and in that way, to win. Pick how much you save, pick your time horizon, and move on — leave the hard investment selection to them. You may not get the best results, but your money is working for you in all the most important ways. 20% of the complexity, 80%+ of the result.

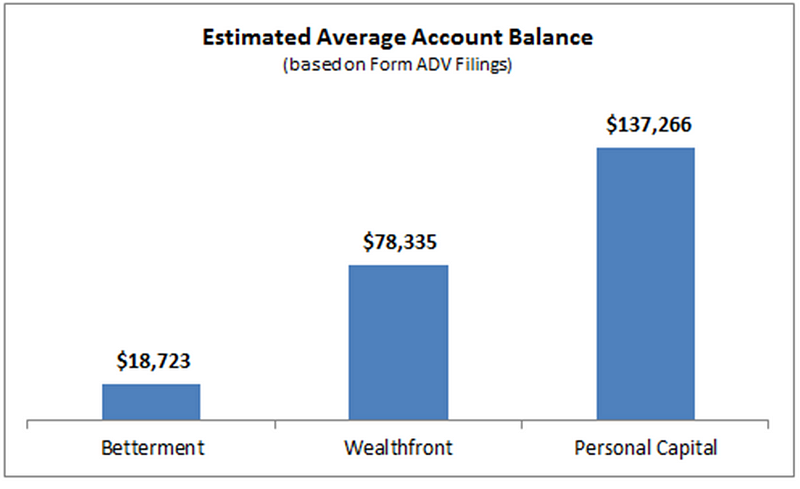

Their average account balance is ~$20K, highlighting who their service si resonating with — the low net worth people who want advice, but don’t get the time of day from a human adviser. Here, controlling cost and not making mistakes are the key to success, and Betterment

Wealthfront: The “Best” Advice Algorithm

Front and center on the home page: The 5 things we do and the extra performance lift they provide

Front and center on the home page: The 5 things we do and the extra performance lift they provide

Do you always have the best of everything? Do people ask you where to eat, what gear to buy, what hotel to stay at knowing that you have done the research and have solid recommendations? Wealthfront is for you.

Cutting edge, with levels of complexity waiting for those who want to dig in and learn, they are about delivering the most efficient experience on your behalf at a regularly low cost. They are about making the tools institutional investors get available to individual investors.

Once again, their ~$80K average balance (~4 times Betterment’s) shows who is buying this pitch. Their tools don’t make much of a difference for people with small balances, which means their fees, while low, are probably too high for folks in the bottom half of Mass Affluent and down.

On the other end, you don’t get an adviser, to help with complicated situations like deciding which tranche of your equity compensation to sell or how to set up a trust for your kids — and that could keep them from winning with the truly wealthy. But if you want to best pure investment performance at the lowest cost for service, you’ve found your home.

Robin Hood: Building in the Whitespace

I don’t have average balances for Robin Hood, but this is a typical review — a new trader, concerned about $7 commissions getting in the way of profits. Not the most profitable customer, not that there’s anything wrong with that.

I don’t have average balances for Robin Hood, but this is a typical review — a new trader, concerned about $7 commissions getting in the way of profits. Not the most profitable customer, not that there’s anything wrong with that.

The others use technology to achieve operational efficiency, but they are primarily trying to deliver great advice at a reasonable cost. Personal Capital tries to scale the human touch. Wealthfront and Betterment focus on better, cheaper advice / results via algorithm. Robin Hood is not about advice. It is about low cost. They have a product that is several years ahead of the industry, in terms of pricing and design — but both of those are easy to beat.

All the brokerages know that commissions are going to $0, the only questions is how long it will take. Internally, most of them pay only pennies to place trades, so they are enjoying the commissions while they can. They do not see Robin Hood’s price as a serious threat.

They also all know that trading is increasingly mobile. They are slowly rolling out their own tools, many of them offering more complete functionality than Robin Hood already. Design is a differentiator, but an apps design does not offer much of a moat (just look at Tidal vs. Spotify). The established players can and will poach the best of what Robin Hood built.

If Robin Hood doesn’t add some sort of advanced trading or algorithmic advice to further differentiate, they are at risk of being commoditized and competed away. So what is Robin Hood’s business plan?

I think they are skating to where the puck will be. Perhaps their smartest innovation, is building a tool to appeal to a really under-served market: The young, poor, and educated. Educated enough to want to make their own decisions, young enough to be ok with a mobile only, low service touch product (if they had money to play with, they would qualify for free trades on a number of much more powerful and complete platforms). Like the comment in the header, this platform is excellent for people who think they can take on the market, but don’t have a lot of money to do it — yet.

And that yet is the key. The wealth management industry under invests in acquiring young clients. In a few years, these beginning investors will be older, wealthier, and more experienced. They will use more margin. They will be more profitable. The establishment will finally be interested. And acquiring Robin Hood will be a nice way to pad to their ever aging account base with young, increasingly more profitable customers.

A One Shot Summary

An over simplified way to see that these upstarts are attracting very clear whitespaces in the market, at the edges and bottom of a graph where most incumbents are at the top extremes or squarely in the middle.

More beautiful PowerPoint. Feast you eyes

More beautiful PowerPoint. Feast you eyes